Unlocking Real Estate Investment Potential with EDSCR

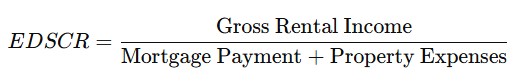

As a real estate-focused platform, Christine Jiyoun provides invaluable insights into the New York property market, investment opportunities, and financing strategies. For investors seeking a simplified, scalable financing approach, EDSCR (Economic Debt Service Coverage Ratio) loans have emerged as a game-changing solution.

By prioritizing rental income over personal earnings, EDSCR loans make it easier for real estate professionals, landlords, and entrepreneurs to secure funding for rental properties, short-term rentals, and multi-unit investments.

This article will explore how ChristineJiyoun.com can leverage EDSCR to empower real estate investors with seamless financing solutions, market insights, and strategic investment tools.

What is EDSCR DSCR LOANS and Why Does It Matter?

The Basics of EDSCR Loans

✔ Self-employed investors who don’t have W-2 income.

✔ Portfolio landlords looking to finance multiple properties.

✔ Short-term rental (STR) owners needing loans based on Airbnb/VRBO earnings.

✔ Fix-and-flip investors requiring quick loan approvals.

📢 How It Works: If your rental income covers the mortgage and operating expenses at a ratio of 1.25 or higher, lenders consider your property a strong investment.

✔ 1.25+ EDSCR – Strong rental performance, easier loan approval.

✔ 1.0 – 1.24 EDSCR – Break-even point, may require reserves.

✔ Below 1.0 EDSCR – Insufficient cash flow, higher risk for lenders.

Why Christine Jiyoun Should Focus on EDSCR

As a platform dedicated to real estate investors, ChristineJiyoun.com can educate its audience on:

✅ How to qualify for EDSCR loans in New York and beyond.

✅ How STR and long-term rental investors can leverage EDSCR for financing.

✅ How EDSCR helps self-employed real estate professionals secure funding.

✅ Where to find EDSCR-friendly lenders and financing options.

How EDSCR Financing Enhances Real Estate Investment on Christine Jiyoun

Christine Jiyoun serves as a resource hub for real estate professionals, and integrating EDSCR-focused financing strategies can help users maximize property acquisitions while improving financing options.

🔹 1. Helping Investors Qualify for Faster Loan Approvals

Traditional mortgages often require:

🚫 Tax returns, W-2s, and debt-to-income (DTI) calculations.

🚫 Extensive employment history verification.

🚫 Long approval processes that slow down deal-making.

With EDSCR loans, real estate investors can bypass these barriers and qualify based on property rental income alone.

📢 ChristineJiyoun.com can offer guides on:

- How to prepare for an EDSCR loan application.

- Which lenders specialize in EDSCR-based financing.

- How investors can structure deals for higher EDSCR ratios.

🔹 2. Supporting STR Investors & Airbnb Hosts

New York’s short-term rental (STR) market is highly competitive, and financing Airbnb or VRBO properties through traditional banks can be difficult.

ChristineJiyoun.com can help STR investors by:

✔ Highlighting lenders who accept STR income in EDSCR calculations.

✔ Providing insights into market trends for high-yield rental properties.

✔ Advising on how to improve EDSCR ratios through rental pricing strategies.

📢 Investor Tip: Many lenders still use long-term rental estimates when calculating EDSCR, but some accept STR revenue projections—knowing the difference is key.

🔹 3. Guiding Investors Through EDSCR-Based Portfolio Expansion

For real estate investors looking to scale, EDSCR loans offer a flexible way to finance multiple properties. Since these loans are based on cash flow, not personal debt-to-income ratios, investors can qualify for more financing opportunities.

📢 ChristineJiyoun.com can offer:

✔ Case studies on investors using EDSCR to expand portfolios.

✔ Tips on managing multiple EDSCR loans strategically.

✔ Guidance on refinancing strategies using EDSCR-backed properties.

🔹 4. Helping Investors Navigate EDSCR Loan Requirements

To qualify for optimal EDSCR financing terms, investors need to meet certain criteria.

✔ Strong rental market data to support income projections.

✔ Good credit history (typically 680+ for best rates).

✔ 6-12 months of cash reserves for mortgage payments.

✔ A well-structured investment plan to demonstrate risk management.

📢 ChristineJiyoun.com can provide:

- Lender comparisons for investors.

- Best practices for securing EDSCR financing.

- How to structure real estate investments for better EDSCR ratios.

Final Thoughts: Why Christine Jiyoun Should Prioritize EDSCR Education

By focusing on EDSCR financing, Christine Jiyoun can become a go-to resource for real estate investors seeking smarter, faster, and more scalable financing options.

✔ Faster loan approvals – Less paperwork, quicker funding.

✔ Portfolio-friendly financing – No limits on properties owned.

✔ STR-friendly lending – Supports Airbnb and short-term rental investors.

✔ No personal income verification required – Ideal for self-employed investors.

🚀 If you’re looking to fund your next investment property, EDSCR loans provide a powerful financing alternative—and ChristineJiyoun.com is here to guide you every step of the way.

🔹 Explore how EDSCR financing can work for you today!